1292 results found

Featured results

More results

This article reviews five economic shocks that are worsening the bankability of new infrastructure projects, and eight approaches to improve bankability and get projects off the ground.

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

The Coalition for Climate Resilient Investment (CCRI) today announced that it has successfully completed the transfer of its portfolio of government and investor-focused climate tools, solutions, and financial instruments to not-for-profit partners. Supported by the CCRI board, the GI Hub is intended to take the role of Secretariat, responsible for collaborating with and supporting the CCRI legacy partners who will continue delivering the core programs begun by CCRI.

Infrastructure definitions and classifications (taxonomies) have a huge impact on how much gets invested in infrastructure and what types of infrastructure get this investment. This week the G20 and GI Hub held a roundtable on infrastructure taxonomies to explore how they can be used to help close the infrastructure investment gap.

The Global BIM Network collaborates to co-develop and host an online, open-access knowledge base of resources from governments and organisations championing BIM in public sector construction and infrastructure projects.

Despite the turmoil in the banking sector, now is not the time to become more risk averse about investing in infrastructure.

The Global Briefing Report Review looks at the outcomes and discussions of the Indonesian G20 Presidency and provides an in-depth review of the Summit that gives readers insights into how it will influence global affairs in the future.

Private infrastructure investment has been stagnant for eight years running, however the number of transactions has been trending up since 2016. This is mainly due to a tripling in the number of solar photovoltaic projects. Unfortunately, their average transaction size is the lowest among all infrastructure sector projects so does not translate to an increase in the total private investment amount.

In partnership with seven MDBs, the GI Hub has issued a Call for Submissions for technology-enabled solutions for sustainable roads. The program will provide governments and investors with a pipeline of technology-enabled solutions to make roads more sustainable, and will give technology solution providers an opportunity to pitch their solutions to MDBs for use on current and future road projects.

To mark International Women’s Day 2023 we invited infrastructure students from University College London to quiz GI Hub leaders on how innovation and technology can advance gender equality.

This week the Australian British Chamber of Commerce, the GI Hub and KPMG co-hosted an intimate infrastructure roundtable with the Lord Mayor of the City of London and senior Australian private sector participants, industry associations, think tanks, government, and infrastructure agencies.

The first meeting under the Indian G20 Presidency of the G20 Finance Ministers and Central Bank Governors in Bengaluru, India was a productive meeting, despite the ongoing problems evident on the global stage. Our CEO Marie Lam-Frendo discusses the outcomes.

In this Q&A we speak to IRIS CEO and Co-founder Emil Sylvester Ramos, to find out how winning the GI Hub’s 2021 innovation competition has helped IRIS to scale globally and reach emerging markets.

Mastercard worked with Transport for London to complement TfL’s closed-loop Oyster system with open-loop EMV payment acceptance, which enables riders to use their own payment card or an enabled device that they already carry with them to pay for public transit. TfL was the first transport system to implement an open-loop EMV payment system.

This report was produced by an expert panel tasked with independent review of multilateral development banks’ capital adequacy frameworks. This panel was convened by the G20 to provide benchmarks to evaluate MDB capital adequacy frameworks and to enable stakeholders to develop a consistent understanding and consider potential adaptations to maximise MDBs' funding capacity.

The Miundo Misingi Hub capacity-building program in Africa is improving collaboration between the public and private sectors and shifting the continent's infrastructure financing.

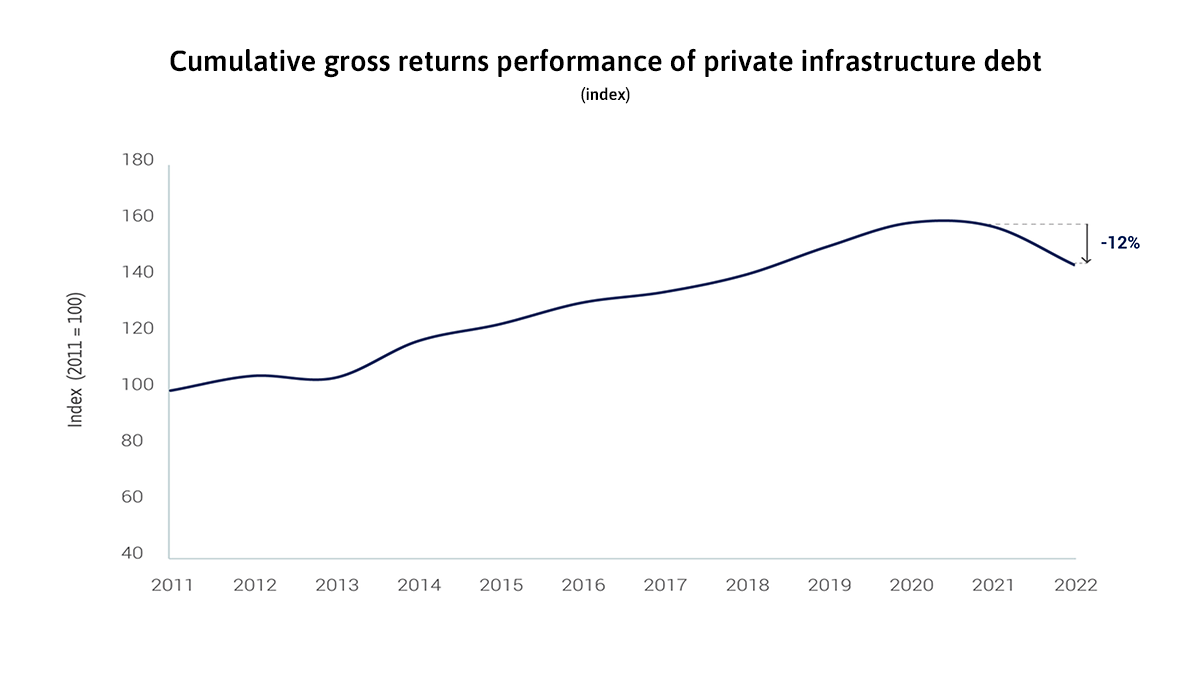

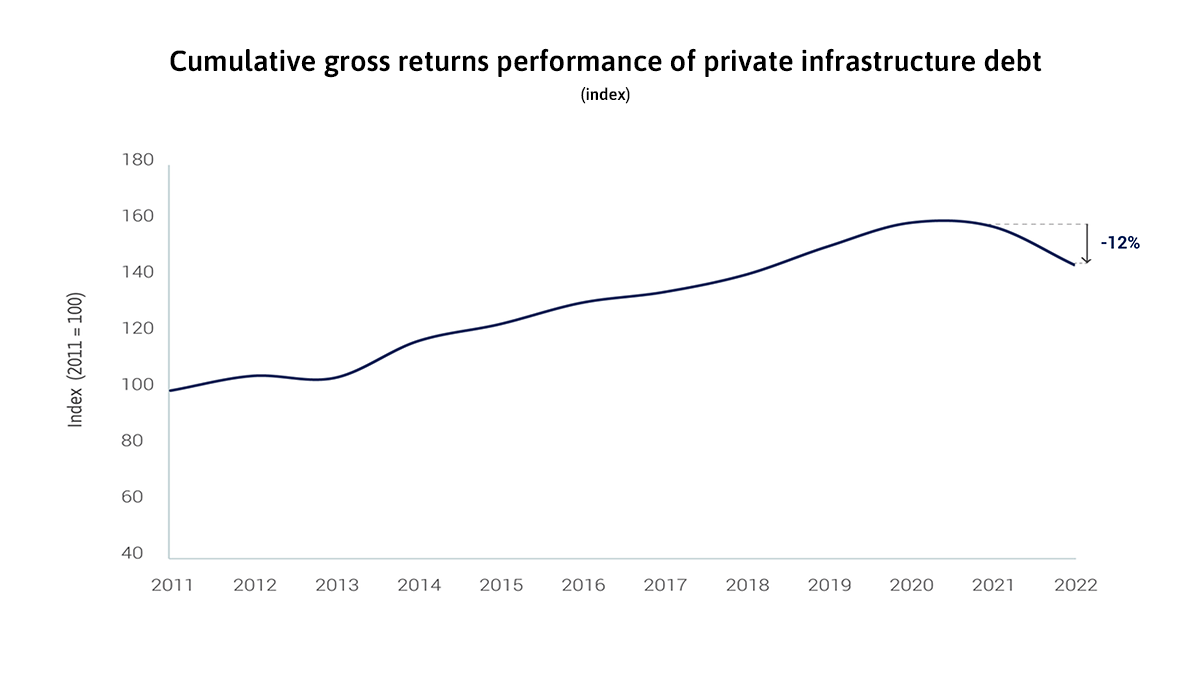

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

The InterAmerican Development Bank´s Sustainable Infrastructure Framework aims to help foster shared understanding of the key dimensions and attributes of sustainable infrastructure. The IDB Framework was adapted to Mexico after a thorough analysis of Mexico’s national development strategy and infrastructure investment priorities, in close collaboration with relevant stakeholders.

Infrastructure Monitor policy articles

Infrastructure Monitor policy articles