916 results found

Featured results

More results

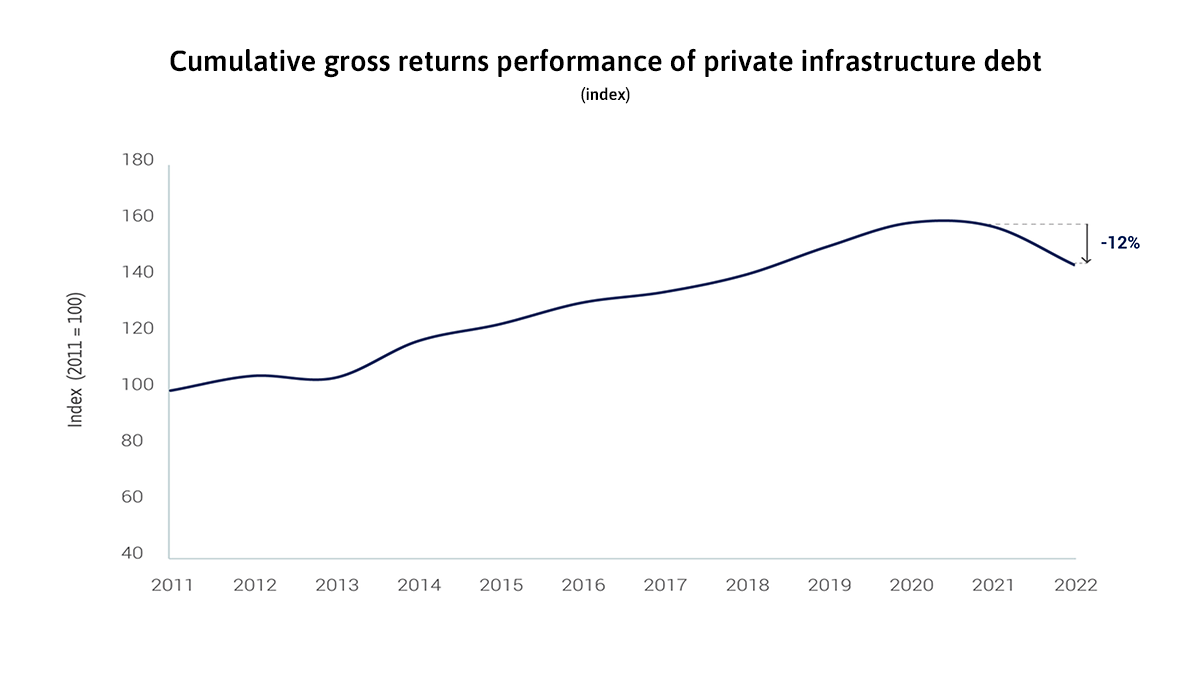

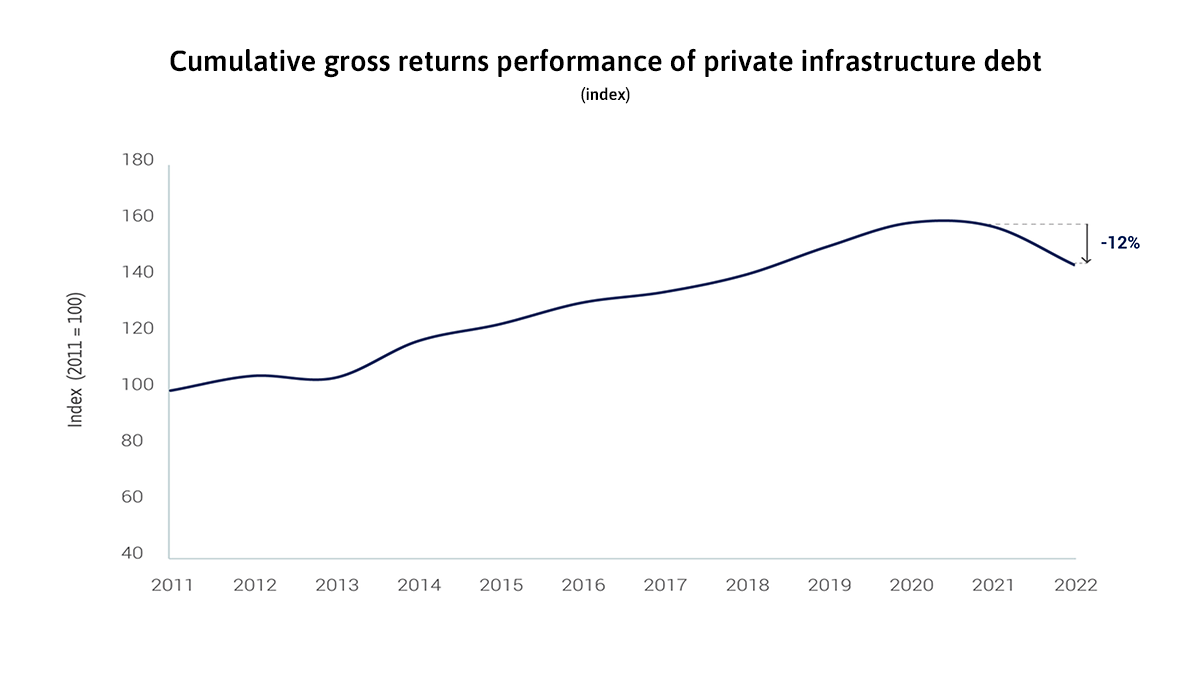

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

Amidst rising interest rates and soaring inflation, infrastructure debt is an increasingly attractive investment strategy for private investors. Alex Murray, Vice President, Research Insights, Preqin explores this trend and what it means for infrastructure investments.

Post-COP15, GI Hub's Strategic Adviser Denis Crevier explores some meaningful outcomes for biodiversity and its influence on infrastructure.

What qualifies as critical infrastructure, and what can governments and industry do to increase its resilience? We spoke to four experts for their perspectives.

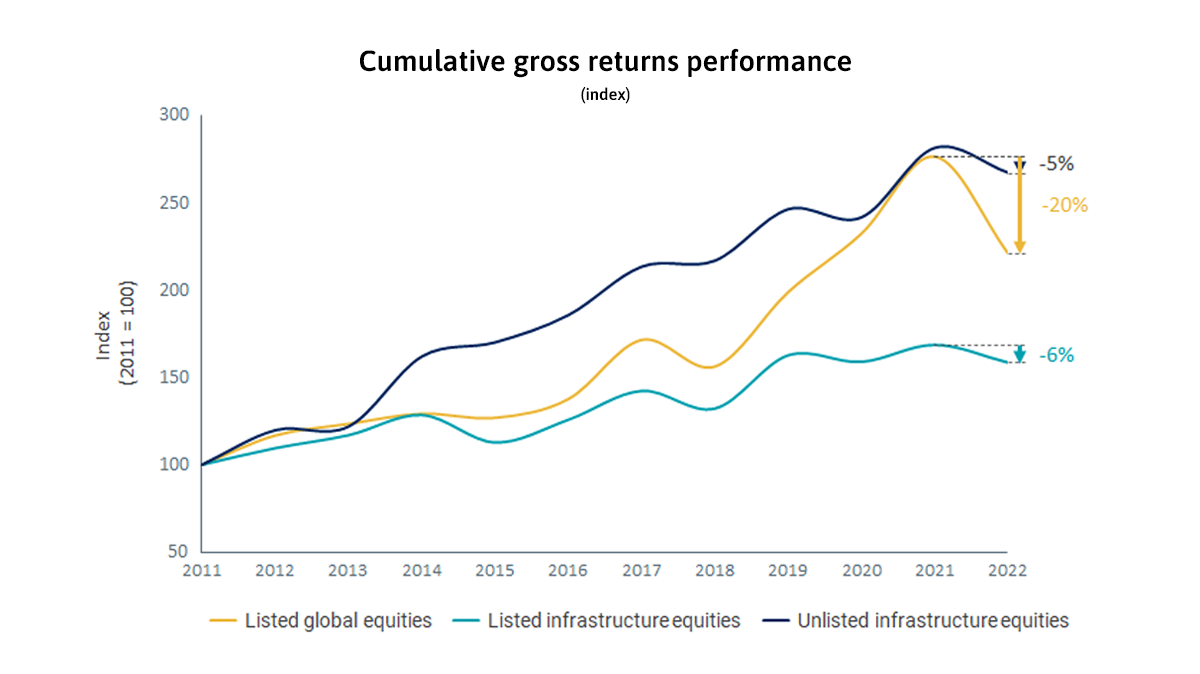

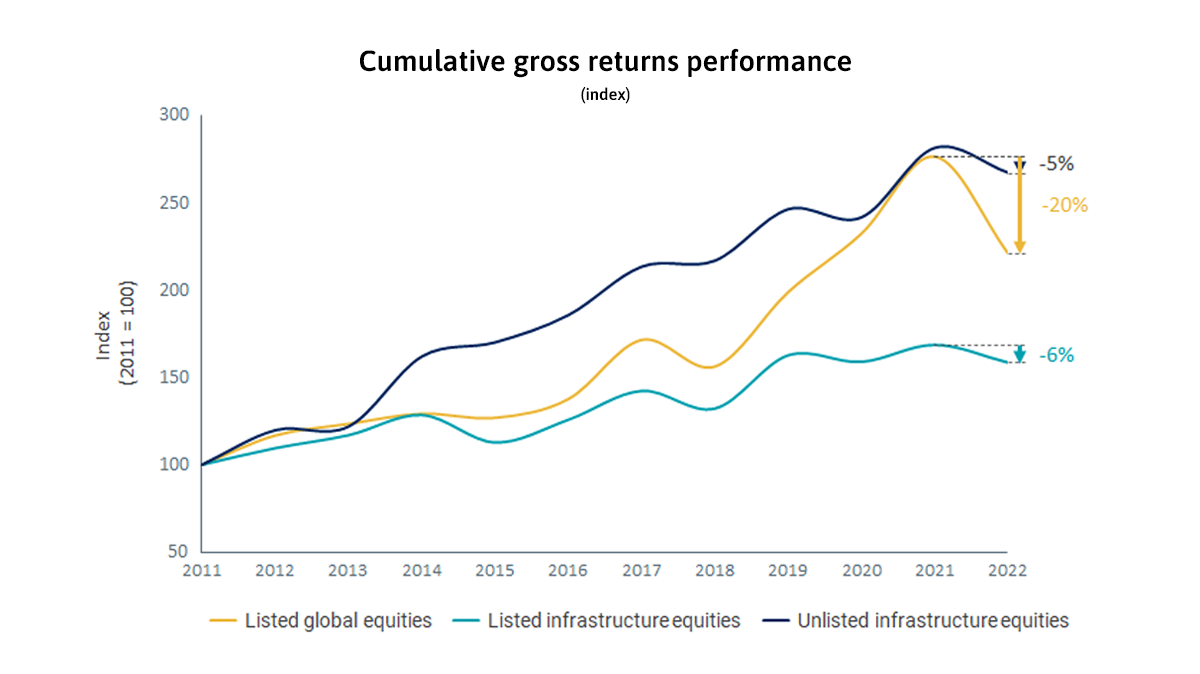

Infrastructure equities provide stronger protection against inflation shocks than the broader equity market. During the rapid inflation shocks in 2022, the return on infrastructure equities was more resilient than that on global equities, which drove private fundraising for infrastructure to record levels.

Watch our CEO Marie Lam-Frendo explore solutions and challenges for decarbonising the transport sector in the latest episode of CNBC's 'Greenprint for a Sustainable Future’ series.

A summary of the first G20 Infrastructure Working Group meeting under the Indian G20 Presidency in January 2023

In this Q&A our CEO, Marie Lam-Frendo explores how the G20 has the power to help bridge the current infrastructure investment gap - a gap that is hindering strong, sustainable development.

In 2021, private investment in infrastructure projects in primary markets recovered to its pre-pandemic level but remains stagnant and far shy of what is needed to close the infrastructure investment gap.

This book questions the premise that Public-Private Partnerships (PPPs) have a performance advantage over traditionally procured projects. It examines novel research comparing the differences in performance between PPP and traditionally procured infrastructure projects and thoughtfully scrutinises the supposed advantages of PPPs.

This study examines all aspects of the digitalisation of infrastructure for a sustainable future

This report from the World Bank looks at the European Union's experience in furthering a circular economy, highlighting lessons that can benefit countries within and beyond Europe’s borders.

The Global Infrastructure Investor Association, in partnership with Marsh & McLennan, examines the impacts that rapid technological advancement are having on infrastructure assets around the world and what these will mean for the sector in years to come.

This report discusses the specific risks to infrastructure investors under each of the key risk categories outlined by the Task Force on Climate-related Financial Disclosures, as well as crucial levers for achieving climate resilience at both the portfolio and asset level for the infrastructure sector.

The Coalition for Climate Resilient Investment (CCRI) created the Physical Climate Risk Assessment Methodology in response to investor demand for comprehensive solutions to improve the integration of physical climate risks into investment appraisal practices.

The Investor Leadership Network created this playbook to help institutional investors better assess and incorporate inclusion into portfolios. It provides the business case for inclusion, fundamental and advanced inclusion metrics, and case studies of the metrics being used.

The Blue Dot Network aims to help mobilise private sector investment by identifying and encouraging market-driven, transparent, and sustainable infrastructure projects. It establishes a voluntary, private-sector focused, government-supported project-level certification that aligns with the G20 Principles for Quality Infrastructure Investment, the UN Sustainable Development Goals, the International Finance Corporation (IFC) Performance Standards, the Equator Principles, the OECD Guidelines for Multinational Enterprises, and the OECD Recommendation on the Governance of Infrastructure.

This report outlines an approach to country platforms to help channel technical assistance and public and private finance to emerging and developing countries in order to support the achievement of net zero targets.

Infrastructure Monitor

Infrastructure Monitor