1292 results found

Featured results

More results

Drawing on current global developments, GI Hub CEO Marie Lam-Frendo offers five recommendations for how governments can act within the 4Ps of planning, policy, performance, and partnership to leverage infrastructure for economic and social outcomes, and to support the low-carbon transition.

With infrastructure responsible for 79% of global GHGs, JETPs have great potential to rebuild trust among stakeholders and help mobilise private climate finance to support the climate transition and sustainable infrastructure development broadly. The JETP platform offers a valuable sandbox to co-create and validate new approaches and innovations while firming up political will

Public investment is 83% of all investment in infrastructure, and lack of data about how this investment is prioritised and allocated impedes private participation and investment. The GI Hub’s InfraTracker is the first annual tracker of public investment in infrastructure for the G20. This article delves into how we estimate public investment priorities, and why doing so isn’t as straightforward as it may seem.

This article examines what trends like slowing globalisation, trade wars, politicisation of trade, and 'friendshoring' mean for infrastructure.

Today the GI Hub has released Transition Pathways to Sustainable Infrastructure, a new resource to help governments shape future infrastructure to meet global climate targets and the UN Sustainable Development Goals with practical, accessible research and open consultations.

In this article, the authors explore the successes and failures of the built environment’s digital transformation to date, why the Smart City concept is necessary but not sufficient and 3 steps for achieving the Adaptive City of the future – one which works for everyone.

The GI Hub is helping ‘connect the dots’ among governments, technology providers, and investors to scale up technological adoption and seize the opportunity for more sustainable roads. Here, we discuss why this is important and what we aim to achieve.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

At last week’s meetings of the G20 Finance Ministers in Washington DC in the margins of the World Bank / IMF Spring Meetings, conversations continued to drive toward action on debt, reform of multilateral institutions, and sustainable finance and investment for the climate transition.

At last week’s meetings of the G20 Finance Ministers in Washington DC in the margins of the World Bank / IMF Spring Meetings, conversations continued to drive toward action on debt, reform of multilateral institutions, and sustainable finance and investment for the climate transition.

In response to a call for submissions issued by the GI Hub and eight multilateral development banks (MDBs) in March 2023, nearly 50 technology providers submitted solutions to make roads more sustainable in emerging markets.

InfraTracker is an open access tool that shows how much governments invest in infrastructure, and how they allocate this investment. It is the first tool of its kind and scale to be developed with the cooperation of G20 governments.

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

"We have multiple gaps to fund, requiring not billions, but trillions"

Transformative changes are needed to unlock infrastructure financing and fill multiple gaps in financing climate, biodiversity, and infrastructure gtargets.

The GI Hub’s InfraTracker aims to help address this data gap by analysing public investment data presented in G20 government budgets

Comparison of InfraTracker data with private investment figures in Infrastructure Monitor also indicate that, in general, governments are the driver of investment in all infrastructure sectors except for energy.

Infrastructure investment undoubtedly has a strong impact on economic growth and development.

InfraTracker tracks public investment in infrastructure to help governments shape programs and budgets that achieve the best outcomes.

This article breaks down the blockers to InfraTech adoption and why they occur. Use this article to deepen your understanding of the repercussions of problems like poorly defined value cases and disparate interests among parties across the timeline.

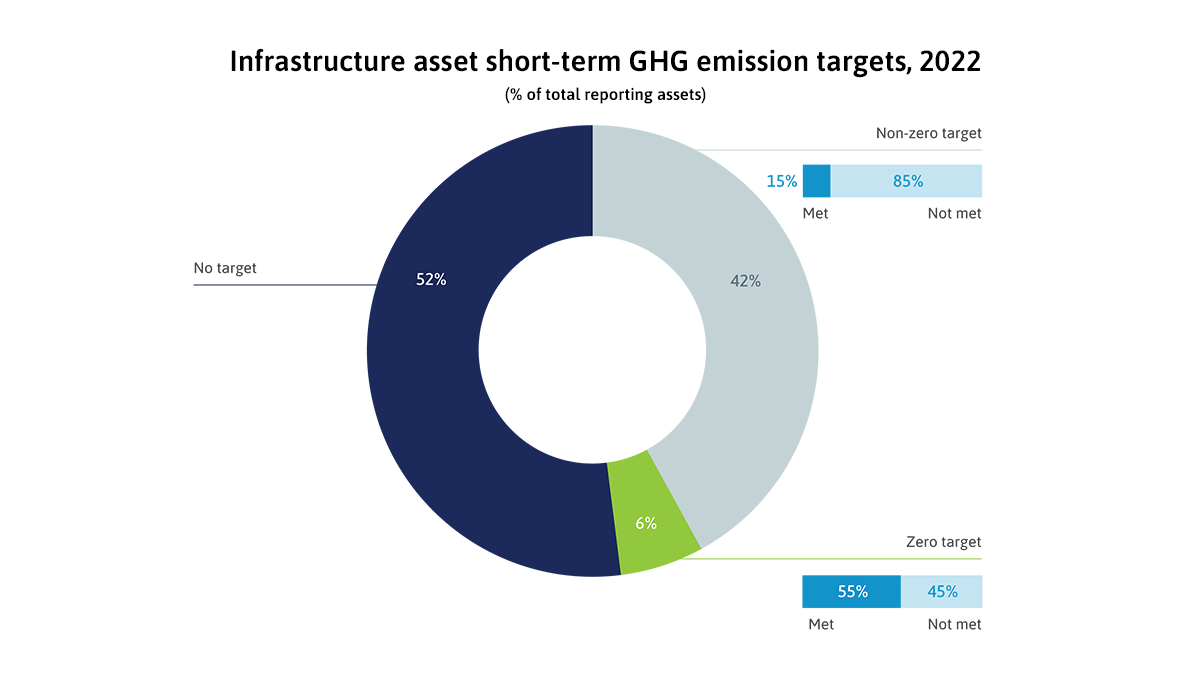

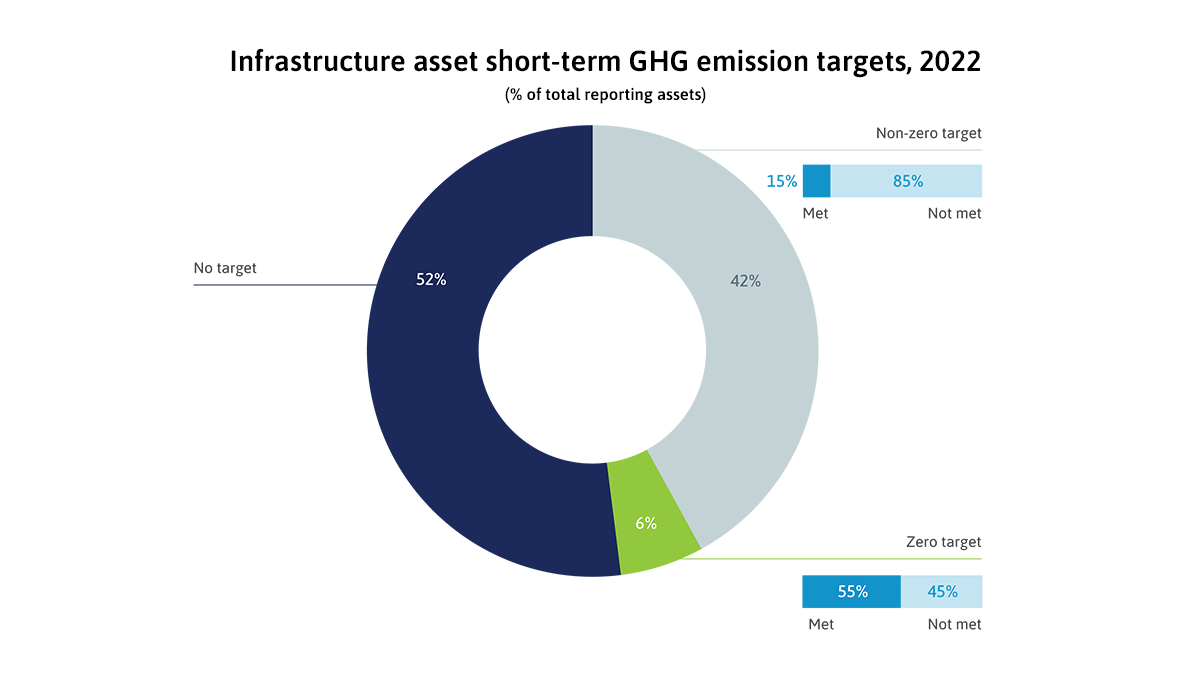

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

InfraCompass

InfraCompass