1111 results found

Featured results

More results

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

"We have multiple gaps to fund, requiring not billions, but trillions"

Transformative changes are needed to unlock infrastructure financing and fill multiple gaps in financing climate, biodiversity, and infrastructure gtargets.

The GI Hub’s InfraTracker aims to help address this data gap by analysing public investment data presented in G20 government budgets

Comparison of InfraTracker data with private investment figures in Infrastructure Monitor also indicate that, in general, governments are the driver of investment in all infrastructure sectors except for energy.

Infrastructure investment undoubtedly has a strong impact on economic growth and development.

InfraTracker tracks public investment in infrastructure to help governments shape programs and budgets that achieve the best outcomes.

This article breaks down the blockers to InfraTech adoption and why they occur. Use this article to deepen your understanding of the repercussions of problems like poorly defined value cases and disparate interests among parties across the timeline.

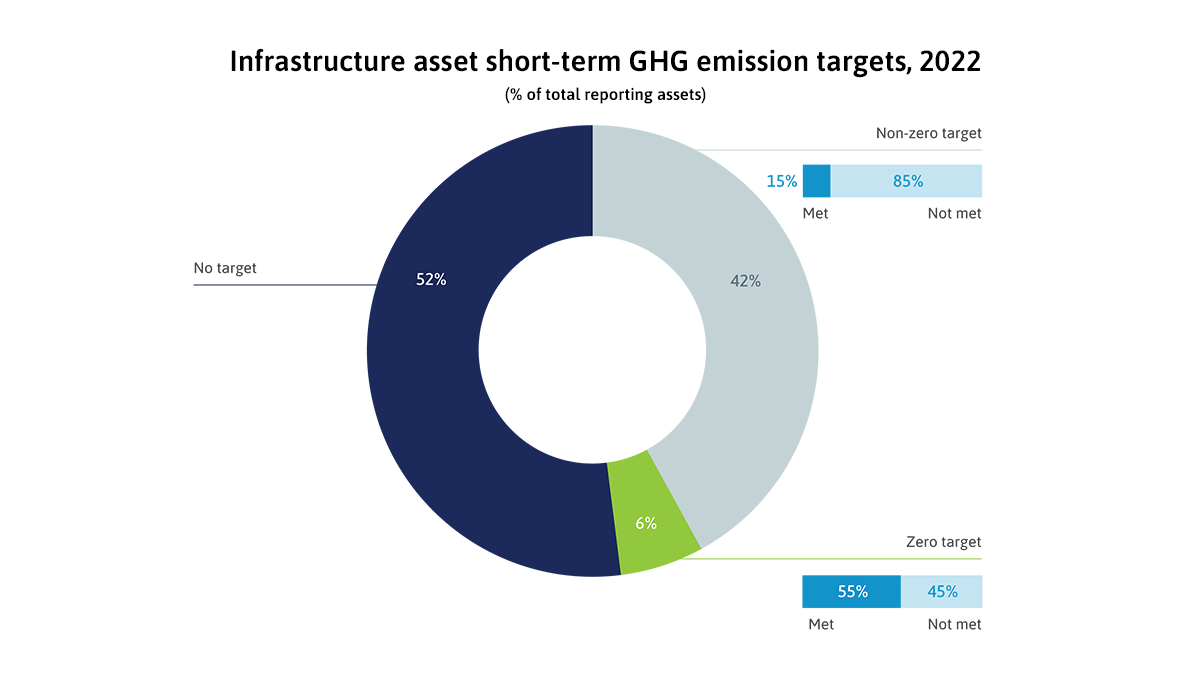

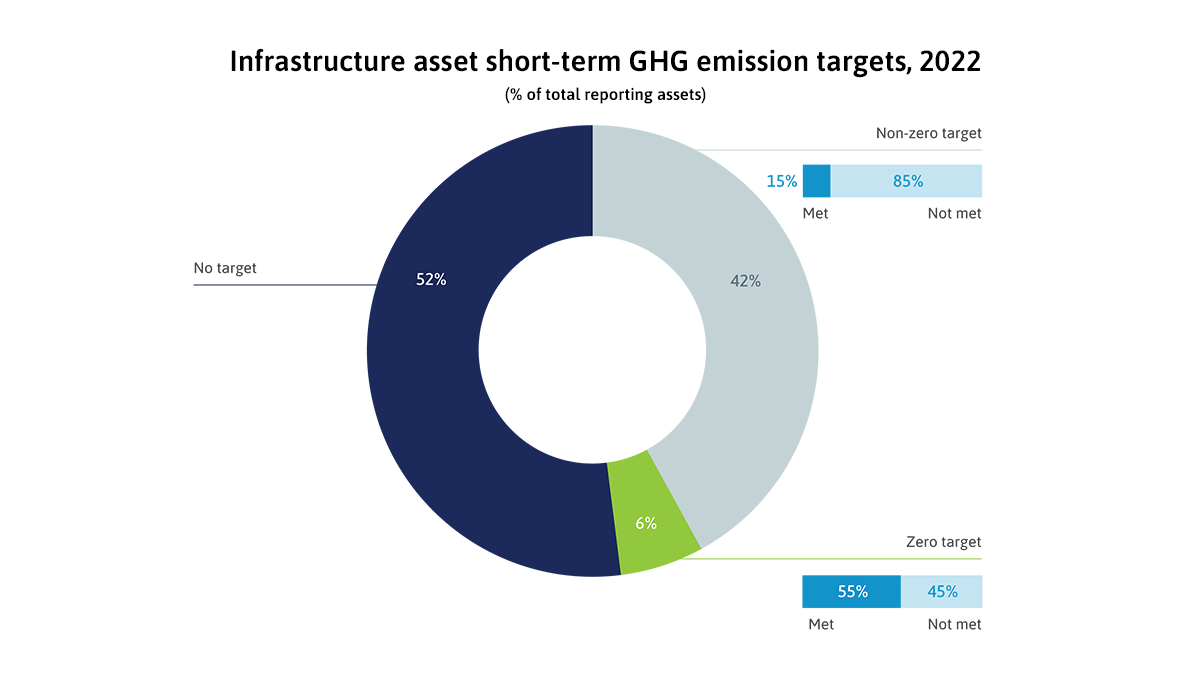

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

This article reviews five economic shocks that are worsening the bankability of new infrastructure projects, and eight approaches to improve bankability and get projects off the ground.

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

The Coalition for Climate Resilient Investment (CCRI) today announced that it has successfully completed the transfer of its portfolio of government and investor-focused climate tools, solutions, and financial instruments to not-for-profit partners. Supported by the CCRI board, the GI Hub is intended to take the role of Secretariat, responsible for collaborating with and supporting the CCRI legacy partners who will continue delivering the core programs begun by CCRI.

Infrastructure definitions and classifications (taxonomies) have a huge impact on how much gets invested in infrastructure and what types of infrastructure get this investment. This week the G20 and GI Hub held a roundtable on infrastructure taxonomies to explore how they can be used to help close the infrastructure investment gap.

The Global BIM Network collaborates to co-develop and host an online, open-access knowledge base of resources from governments and organisations championing BIM in public sector construction and infrastructure projects.

Despite the turmoil in the banking sector, now is not the time to become more risk averse about investing in infrastructure.

The Global Briefing Report Review looks at the outcomes and discussions of the Indonesian G20 Presidency and provides an in-depth review of the Summit that gives readers insights into how it will influence global affairs in the future.

Private infrastructure investment has been stagnant for eight years running, however the number of transactions has been trending up since 2016. This is mainly due to a tripling in the number of solar photovoltaic projects. Unfortunately, their average transaction size is the lowest among all infrastructure sector projects so does not translate to an increase in the total private investment amount.

To mark International Women’s Day 2023 we invited infrastructure students from University College London to quiz GI Hub leaders on how innovation and technology can advance gender equality.

This week the Australian British Chamber of Commerce, the GI Hub and KPMG co-hosted an intimate infrastructure roundtable with the Lord Mayor of the City of London and senior Australian private sector participants, industry associations, think tanks, government, and infrastructure agencies.

Infrastructure Technology (InfraTech)

Infrastructure Technology (InfraTech)