916 results found

Featured results

More results

G20 Leaders endorsed the High Level Principles on Long-Term Investment Financing by Institutional Investors in September 2013, which is intended to help governments facilitate and promote long-term investment by institutional investors.

The G20/OECD Checklist consists of a list of questions and issues that represent an effort to develop an evaluation tool to help those countries who wish to self-assess their long-term investment (LTI) strategy and policy framework and more.

This Checklist for PPPs has been prepared from the point of view of public policy makers and decision-makers in countries at various levels of development and capacities for the purpose of a high level assessment of a PPP project.

An updated Checklist on Long-term Investment Strategies and Institutional Investors stresses on issues related to the identification of long-term investment needs.

The guidelines give concrete advice to countries on how to manage their responsibilities as company owners, thus helping the state-owned enterprises to become more competitive, efficient and transparent.

The OECD Guidelines for Multinational Enterprises provides recommendations to businesses in the areas of disclosure; human rights; employment and industrial relations; environment; combatting bribery and more.

The G20/OECD Principles of Corporate Governance help policy makers evaluate and improve the legal, regulatory, and institutional framework for corporate governance, with a view to supporting economic efficiency, sustainable growth and financial stability.

The LPI provides valuable information for policymakers, traders, and other stakeholders, including researchers and academics, on the role of logistics for growth and the policies needed to support logistics in areas such as infrastructure planning, service provision, and cross-border trade and transport facilitation.

This is a practical guide describing "how to design, implement, and measure progress with regard to knowledge exchange initiatives," according to the World Bank's summary.

The Reference tool is meant to serve as a practical tool to help governments and other stakeholders understand and implement the critical success factors that deliver inclusive infrastructure. The Framework for Inclusive Infrastructure summarises the following six Actions Areas and related practices that ought to be considered for the systematic implementation of inclusivity in infrastructure at the policy and project levels.

How can we drive infrastructure delivery reforms? Join GI Hub and Jacobs on 26 October for the launch webinar of our newest initiative, Improving Delivery Models.

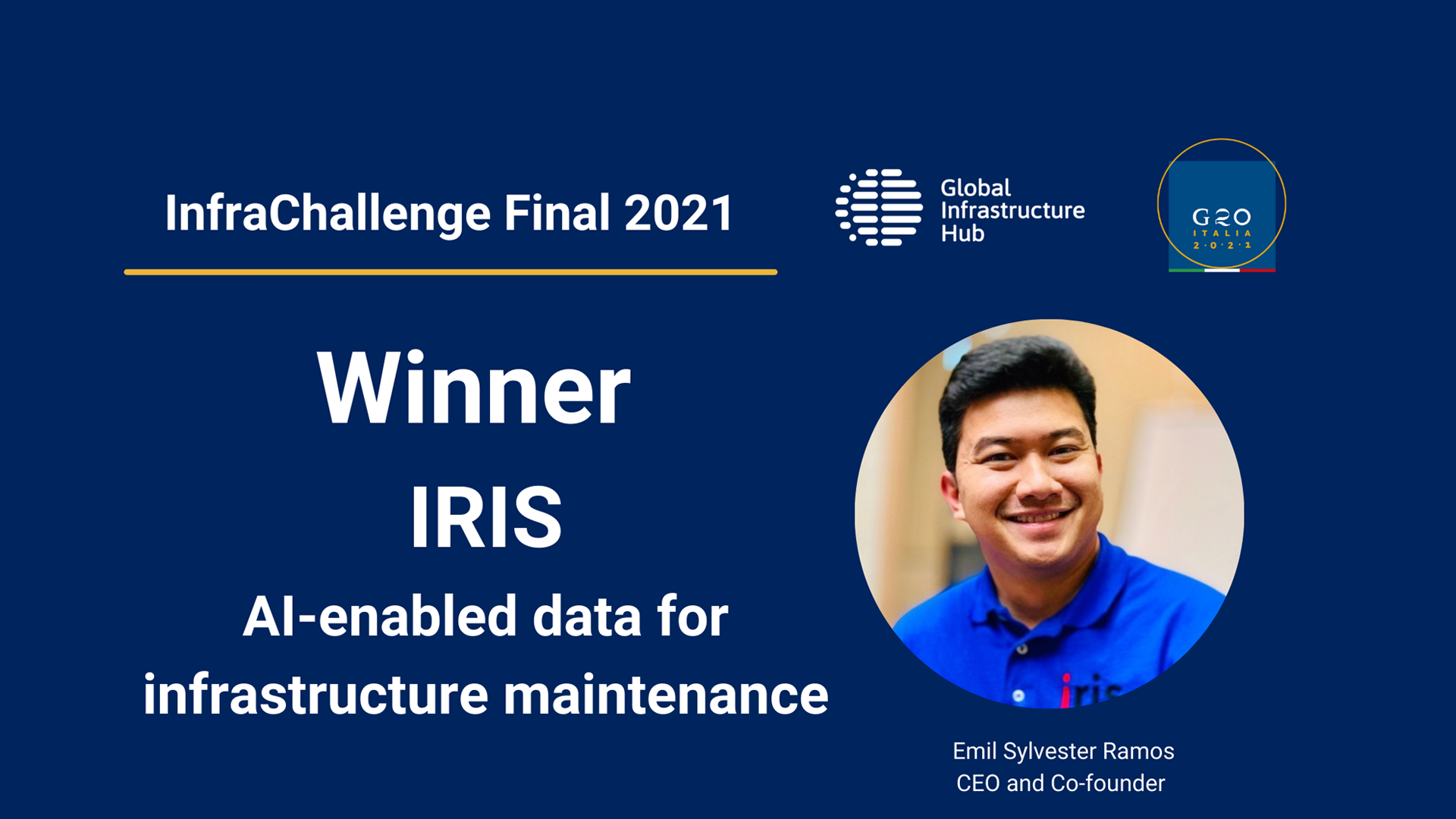

The recording is now available for the GI Hub and Italian G20 Presidency’s InfraChallenge 2021 Final which was held over two-days on 15 and 16 September 2021

What role can the private sector play in a green transition? How is green financing implemented, and what are the current green financing trends? These are a few of the key questions that will be explored in this GI Hub and IFC webinar.

A green bond issuance by Continuum Wind Energy contributed to the continued growth of India's renewable energy sector.

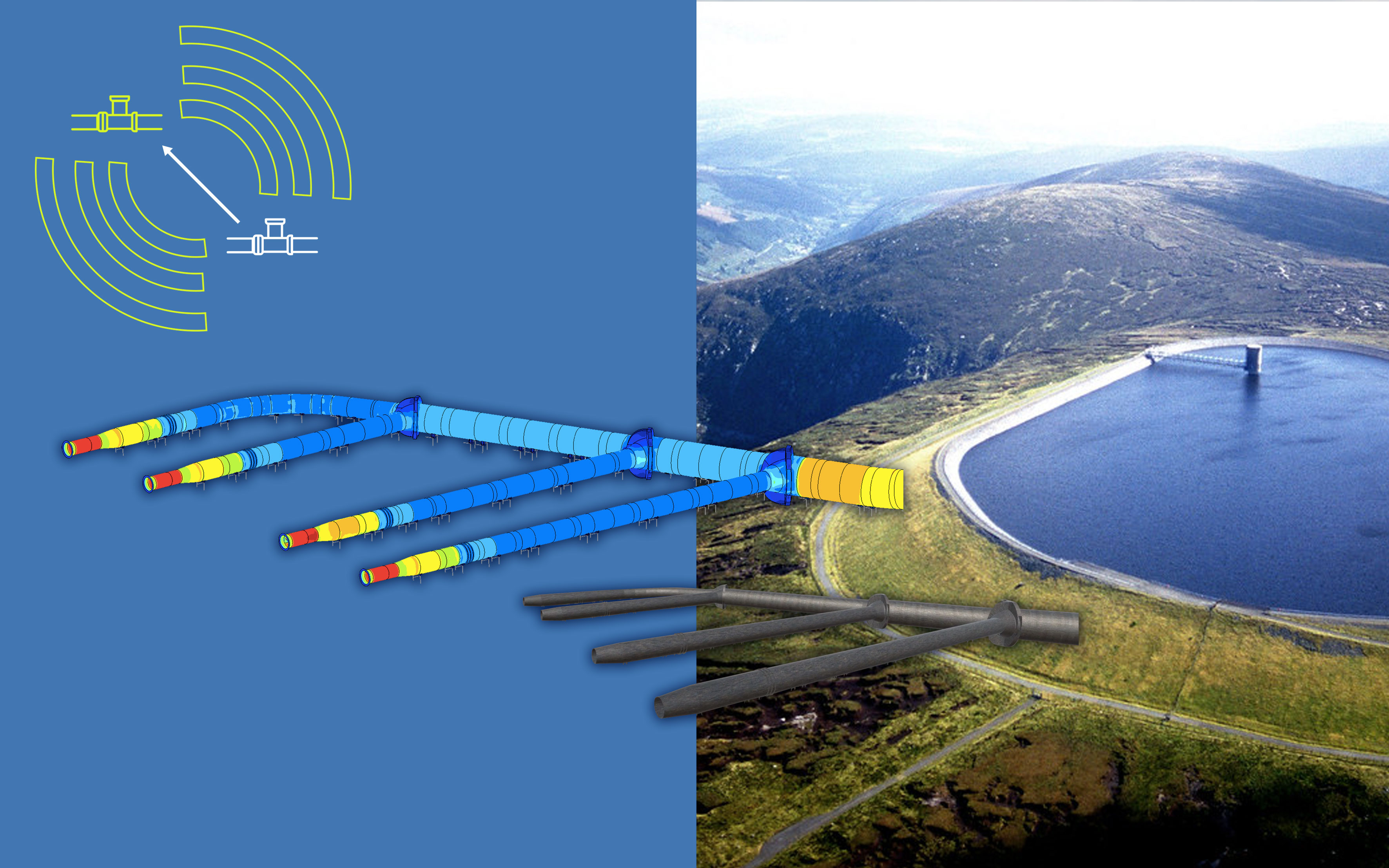

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

AI-enabled cameras detect road hazards in real time, enabling faster and securer maintenance for safer roads. Winning InfraChallenge will assist Canadian start-up IRIS to scale globally and reach emerging countries.

Join the GI Hub and G20 Italian Presidency for day two of the InfraChallenge final, in which the Top 10 competitors will give their final pitches of their solutions, and the 2021 winner will be announced.

This GI Hub and IFC webinar discussed approaches to attracting institutional investors and mobilising capital markets, highlighting solutions and lessons learnt from two recent projects.

With a USD3.7 trillion global infrastructure investment need that continues to widen, and government debt levels substantially higher than they were after the global financial crisis, recent infrastructure bond issuances offer valuable lessons.

Inclusive Infrastructure

Inclusive Infrastructure