916 results found

Featured results

More results

The global pandemic and climate change concerns raised at COP26 have elevated awareness of the need to build sustainable and resilient infrastructure, in tandem with implementing adaptation strategies and governance through innovative and collaborative partnerships between the public and private sectors

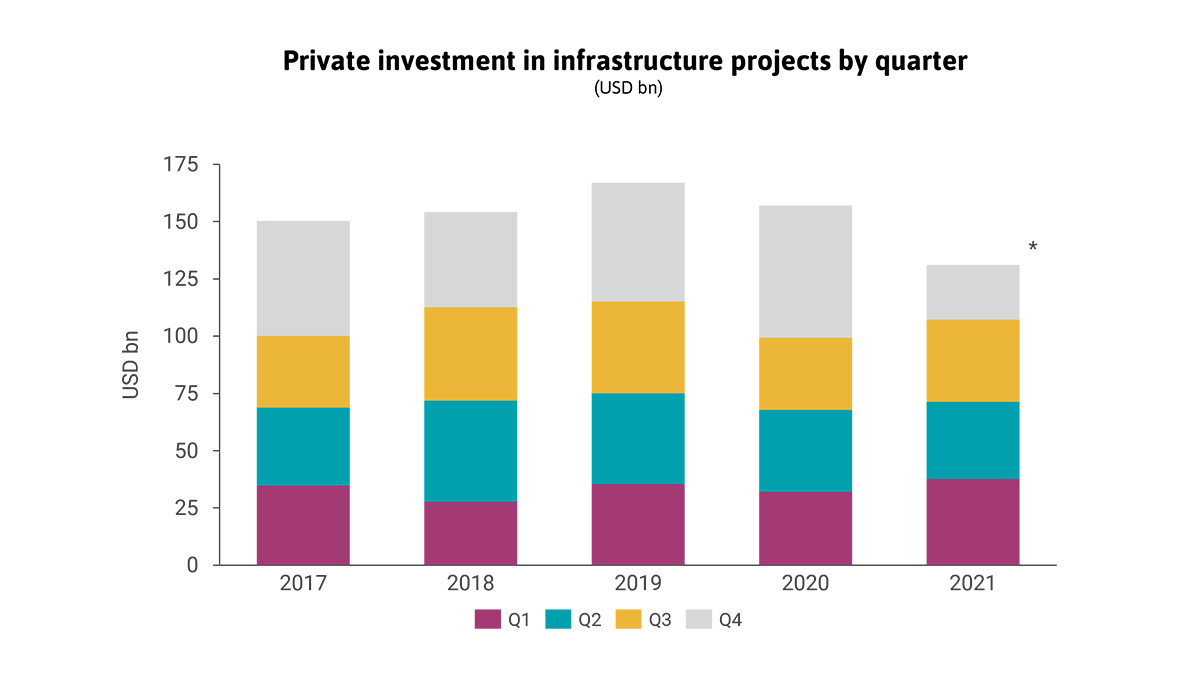

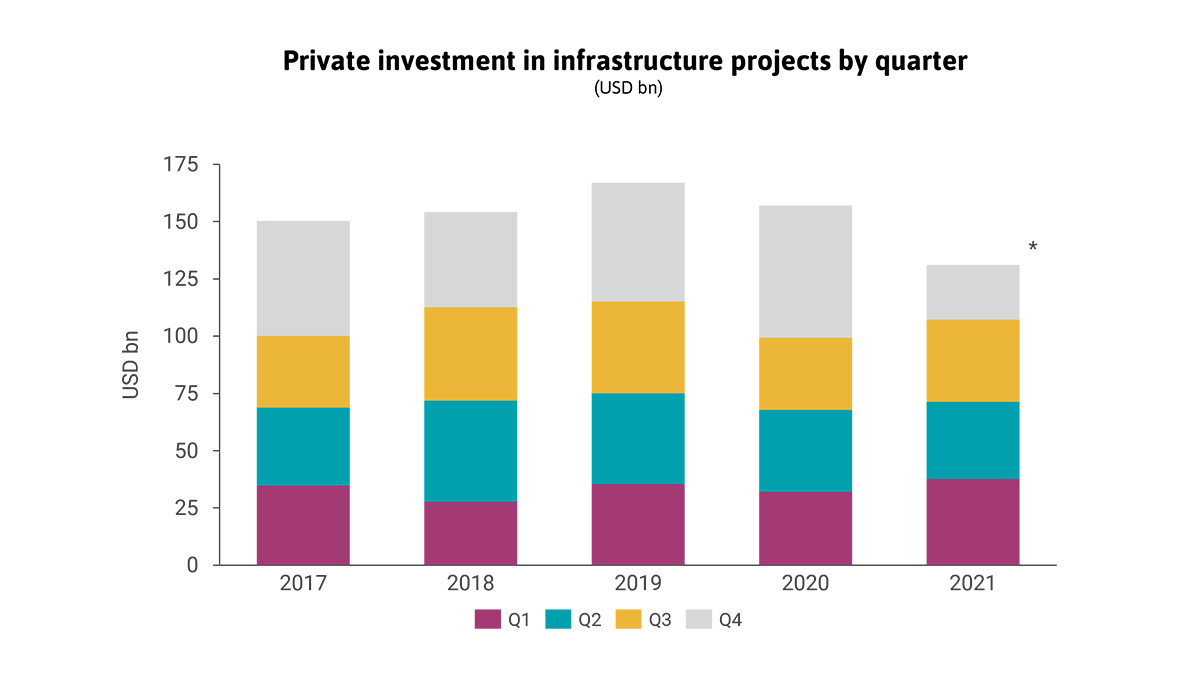

Private investment in infrastructure projects in primary markets was resilient to COVID-19 pandemic shocks

This simple and free tool enables project proponents to easily conduct early-stage cost-benefit analyses of bus transport projects.

Alexandra Bolton, Executive Director of the Centre for Digital Built Britain shares why we need to invest in digital capabilities to improve infrastructure delivery.

Pension investment in infrastructure is moving mainstream, at a time when this move will have even greater potential to help drive positive impacts

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

The policy framework for investment provides a systematic approach for improving investment conditions and a comprehensive checklist of key policy issues for consideration by any government interested in creating an enabling environment for all types of investment.

On 19 January, the Global Infrastructure Hub hosted a seminar in collaboration with the G20 Infrastructure Working Group (IWG) on ‘Scaling up sustainable infrastructure investment by leveraging private sector participation’.

To close the infrastructure gap in a sustainable recovery, we need more greenfield infrastructure, with environmental sustainability at its core. This requires innovative funding models and public-private partnerships (PPPs), particularly in emerging economies where private investors are more reluctant to invest and greenfield infrastructure need is greatest.

Infrastructure Monitor is the GI Hub's annual flagship report on the state of investment in infrastructure.

Infrastructure Monitor is the GI Hub's flagship report on the state of investment in infrastructure. The 2021 report examines global private investment in infrastructure projects, infrastructure investment performance, project preparation, ESG factors in infrastructure investment, and COVID-19 impacts.

The recording is now available for the GI Hub and International Finance Corporation (IFC) webinar ‘Infrastructure for the recovery: Innovation for de-risking greenfield investment’, the third in the series New Deals: Funding solutions for the future of infrastructure.

Innovative win-win power scheduling agreement between the two procurers that enabled Delhi Metro to draw power flexibly to suit the variable nature of its demand for running trains.

The pandemic increased inequalities among vulnerable people and highlighted gaps in access to financing and services in every country. Simultaneously, the climate crisis is still at ‘code red’. From every vantage point, it is clear that we need to get the most possible out of the unprecedented level of infrastructure as a stimulus.

Drawing on examples and case studies, this report aims to provide a framework to optimise existing infrastructure assets and build new resilient infrastructure, including new strategies capable of ensuring quality and performance over the asset life-cycle.

Technological innovation could fill 60% of the infrastructure investment gap, but first we need to address the barriers to financing. On 17 November 2021, the GI Hub is hosting Financing InfraTech for the Climate Transition to explore solutions to galvanise infrastructure technology adoption at scale.

Today, the GI Hub has launched a new resource that shows how G20 governments are spending the USD3.2 trillion in infrastructure as a stimulus.

India's infrastructure needed substantial investment to fulfill the demands of the growing economy. The Indian government introduced various initiatives to demonstrate domestic confidence to foreign investors, including Infrastructure Investment Trusts (InvITs) as an avenue for infrastructure developers to divest operational projects and reduce their leverage.

This research helps governments and industry ensure that infrastructure investment supports climate mitigation and adaptation, resilience, and inclusive outcomes during challenging economic times.

PPP Risk Allocation Tool

PPP Risk Allocation Tool