1021 results found

Featured results

More results

Private investment in infrastructure is dominated by the energy and transport sectors

To seize the opportunities of this critical moment and increase private investment in infrastructure LMICs can implement a series of actions. The creation of a regulatory and institutional framework which promotes private investment or the development of solid project pipelines.

Respond to our annual Stakeholder Survey and help us drive change as pressing global climate and economic problems call for infrastructure that is exponentially more sustainable, more inclusive, and more resilient.

One Planet Summit reports on how blended finance can help scale up climate and nature investments.

Achieving the United Nations Sustainable Development Goals will require massive investment in developing countries. Blended finance, which combines concessional public funds with commercial funds, can be a powerful means to direct more commercial finance toward impactful investments that are unable to proceed on strictly commercial terms

Infrastructure project preparation capacity is weak across most regions of the world. It is critical to strengthen these capabilities to address one of the major bottlenecks in attracting private capital to infrastructure, which is the lack of a bankable, investment-ready pipeline of infrastructure projects

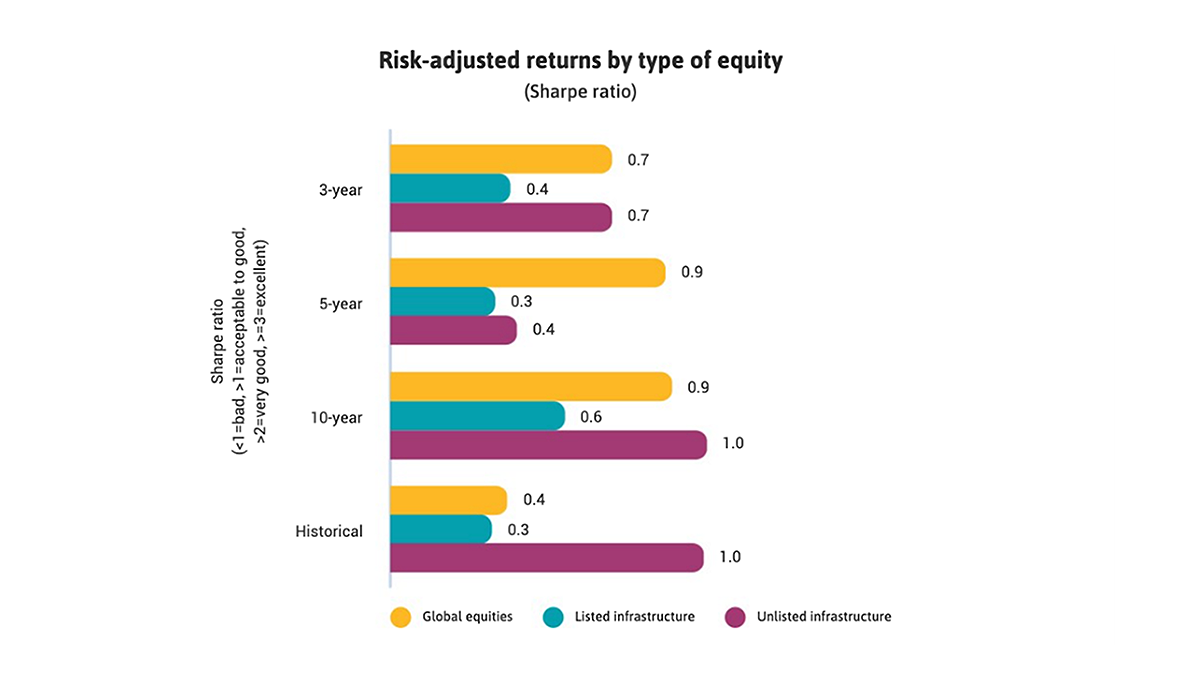

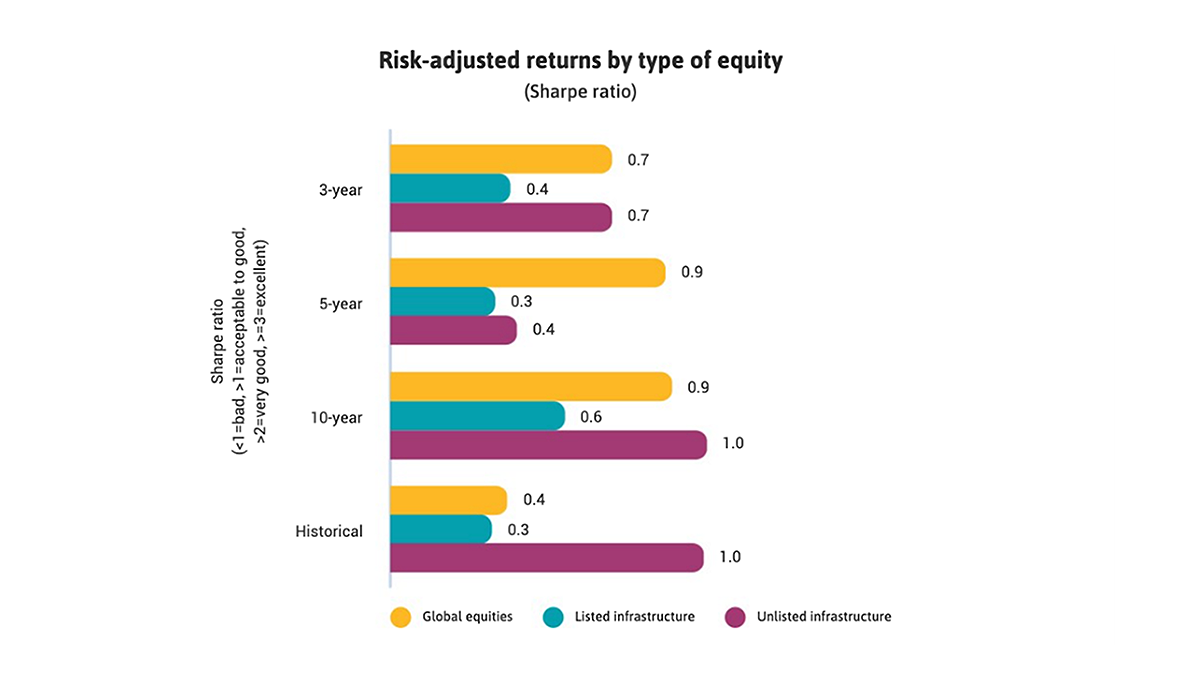

For investors seeking to diversify and optimise their portfolios, infrastructure debt and unlisted infrastructure equities are very strong options, according to long-term data

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

This paper provides a contextual commentary on the state of infrastructure delivery around the world. The views within are not necessarily that of the GIobal Infrastructure Hub (GI Hub) but are an important viewpoint to contextualise use of the GI Hub’s Improving Delivery Models initiative framework

To increase understanding and improve the consideration of circular infrastructure, the GI Hub has formed a Circular Economy in Infrastructure Action Group that includes global, senior leaders in circular economy and infrastructure across the public and private sector.

Unlisted infrastructure equities have provided higher risk-adjusted returns to investors than an average global listed equity. With greater recognition of its attractive performance, investors’ demand has increased, and returns have aligned over time with its lower risk or volatility

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The third Q&A in this series is with Monica Bennett, GI Hub’s Director of Thought Leadership.

The GI Hub is seeking evidence of successful approaches for financing and developing InfraTech that can be scaled and replicated across sectors and jurisdictions

Equity and debt performance show that infrastructure as an asset class provides attractive and resilient returns for investors and unlisted infrastructure equities generated the highest returns and risk-adjusted returns.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The second Q&A in this series is with Cinthya Pastor, GI Hub’s Director of Economics.

Infrastructure debt has a highly attractive and resilient risk-return profile for investors. Expected losses are particularly low given high recovery rates in cases of default

This session examined how innovative forms of commercial financing are being mobilised to finance sustainable infrastructure

This webinar will explore how governments and project proponents can mobilise innovative forms of commercial financing like blended finance and sustainability-linked loans.

In April 2021, the GI Hub hosted a workshop for the G20 Infrastructure Working Group (IWG) on the role of infrastructure in the circular economy. The workshop brought together the following experts in circular economy and infrastructure to identify synergies between the two sectors and explore how these opportunities can be implemented across the world.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The first Q&A in this series is with Maud de Vautibault, GI Hub’s Director of Practical Tools and Knowledge.

Infrastructure Monitor

Infrastructure Monitor