1021 results found

Featured results

More results

The QII Principles are voluntary, non-binding principles that reflect a common strategic direction and aspiration for quality infrastructure investment.

The Blueprint provides a set of evidence-based, voluntary, non-binding actions to advance the six elements of the G20 InfraTech Agenda.

The QII Principles are voluntary, non-binding principles that reflect a common strategic direction and aspiration for quality infrastructure investment.

At recent G20 meetings, the public and private sectors were aligned on many actions for strong, sustainable, balanced, and inclusive growth and recovery

Infrastructure is key to achieving fair and sustainable economic growth and climate targets. Three trends to stimulate the private sector to fund the large-scale change to enable infrastructure to reach its climate and development potential

The green bond market has seen exponential growth since its inception in 2007. In 2020, green bonds represented 60% of bond issuances for private investment in sustainable, primary infrastructure globally, mostly concentrated in developed regions.

Policies that governments in emerging markets can advance to facilitate the mobilisation of private sector investment in green and climate-friendly infrastructure.

The GI Hub recently hosted a webinar that provided participants with a data-informed understanding of the state of infrastructure investment. In this article we present the main takeaways from the event.

Open data is another aspect of digitalisation that is gaining traction. This blog explores the importance of open data to infrastructure delivery and offers some practical steps for decisionmakers in the public and private sector to implement and utilise open data.

Preliminary evidence shows superior performance for some sustainable infrastructure investments in comparison with other infrastructure sector investments

The GI Hub presented our report on Infrastructure Transition Pathways, which explores infrastructure transition pathways to achieve global climate targets and sustainable development goals.

The 2022 SIFP fellows hail from 12 countries, and 40% are women

Created in 2018, this executive leadership program offers academic and practical training to public-sector officials in emerging market government ministries, municipalities, organisations, and agencies charged with the development, financing, and operation of infrastructure.

The COVID-19 pandemic boosted investors’ interest in digital infrastructure and digital services. Policymakers have an opportunity to amplify these effects by accelerating market reforms

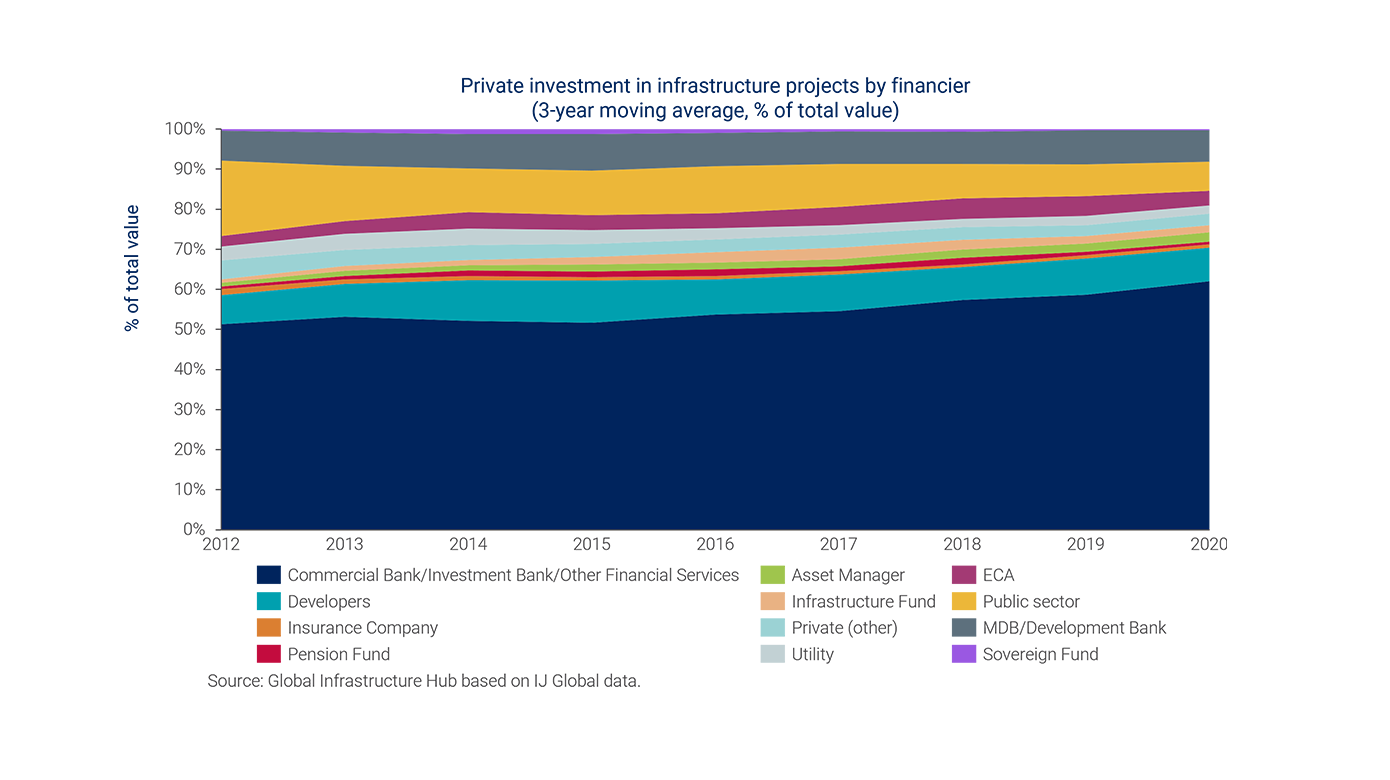

Private investors have shifted away from non-renewables in both developed and developing markets. The appetite for renewables is stronger in developed markets.

Join us for a webinar that will highlight solutions for governments and project proponents to mobilise private financing and inclusive infrastructure investment in order to reach vulnerable groups and underserved regions.

Low private investment in the social, telecommunications, water and waste infrastructure sectors

Join the GI Hub for an overview of investment in the infrastructure sector and hear experts discuss the decisions that will drive strong investment outcomes as well as positive global impacts.

The Global Infrastructure Hub (GI Hub) has announced the formation of a Technical Working Group of global infrastructure, finance, and climate experts to provide strategic advice to the G20 and GI Hub on a forthcoming framework that will offer new recommendations for scaling up private sector investment in sustainable infrastructure.

Integrating ESG into infrastructure decisions requires a systematic and verifiable governance (implementation) approach of a projects ability to reduce environmental and social risk alongside long-term value for investors

The GI Hub began examining the regulatory capital treatment of infrastructure investments in 2019, as part of our initiative to address barriers to the establishment and advancement of infrastructure as an asset class

Compendium of Quality Infrastructure Investment Indicators Guidance Note

Compendium of Quality Infrastructure Investment Indicators Guidance Note