816 results found

Featured results

More results

This paper provides a contextual commentary on the state of infrastructure delivery around the world. The views within are not necessarily that of the GIobal Infrastructure Hub (GI Hub) but are an important viewpoint to contextualise use of the GI Hub’s Improving Delivery Models initiative framework

To increase understanding and improve the consideration of circular infrastructure, the GI Hub has formed a Circular Economy in Infrastructure Action Group that includes global, senior leaders in circular economy and infrastructure across the public and private sector.

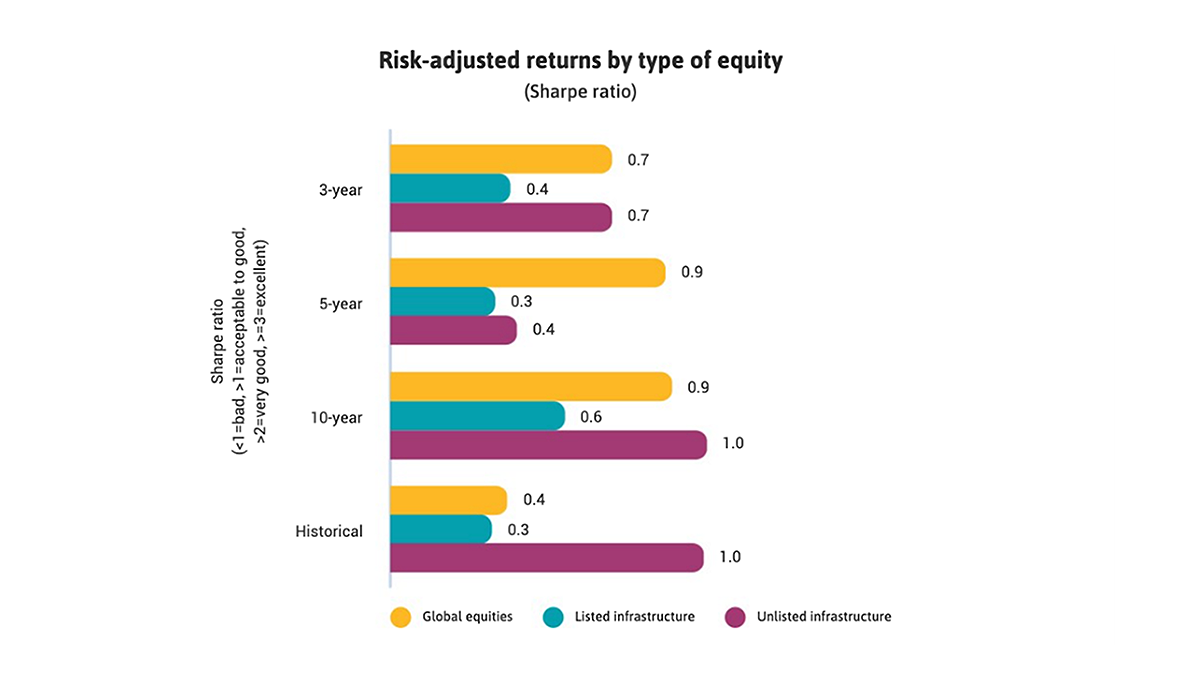

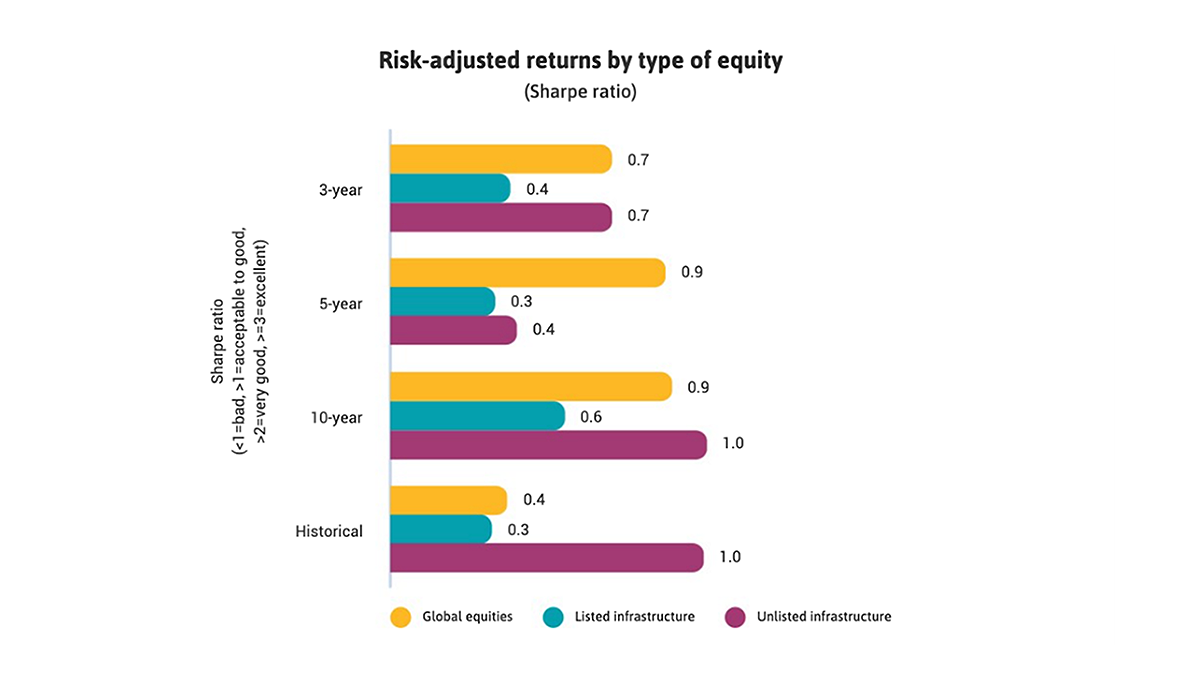

Unlisted infrastructure equities have provided higher risk-adjusted returns to investors than an average global listed equity. With greater recognition of its attractive performance, investors’ demand has increased, and returns have aligned over time with its lower risk or volatility

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The third Q&A in this series is with Monica Bennett, GI Hub’s Director of Thought Leadership.

The GI Hub is seeking evidence of successful approaches for financing and developing InfraTech that can be scaled and replicated across sectors and jurisdictions

Equity and debt performance show that infrastructure as an asset class provides attractive and resilient returns for investors and unlisted infrastructure equities generated the highest returns and risk-adjusted returns.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The second Q&A in this series is with Cinthya Pastor, GI Hub’s Director of Economics.

Infrastructure debt has a highly attractive and resilient risk-return profile for investors. Expected losses are particularly low given high recovery rates in cases of default

This session examined how innovative forms of commercial financing are being mobilised to finance sustainable infrastructure

This webinar will explore how governments and project proponents can mobilise innovative forms of commercial financing like blended finance and sustainability-linked loans.

In April 2021, the GI Hub hosted a workshop for the G20 Infrastructure Working Group (IWG) on the role of infrastructure in the circular economy. The workshop brought together the following experts in circular economy and infrastructure to identify synergies between the two sectors and explore how these opportunities can be implemented across the world.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The first Q&A in this series is with Maud de Vautibault, GI Hub’s Director of Practical Tools and Knowledge.

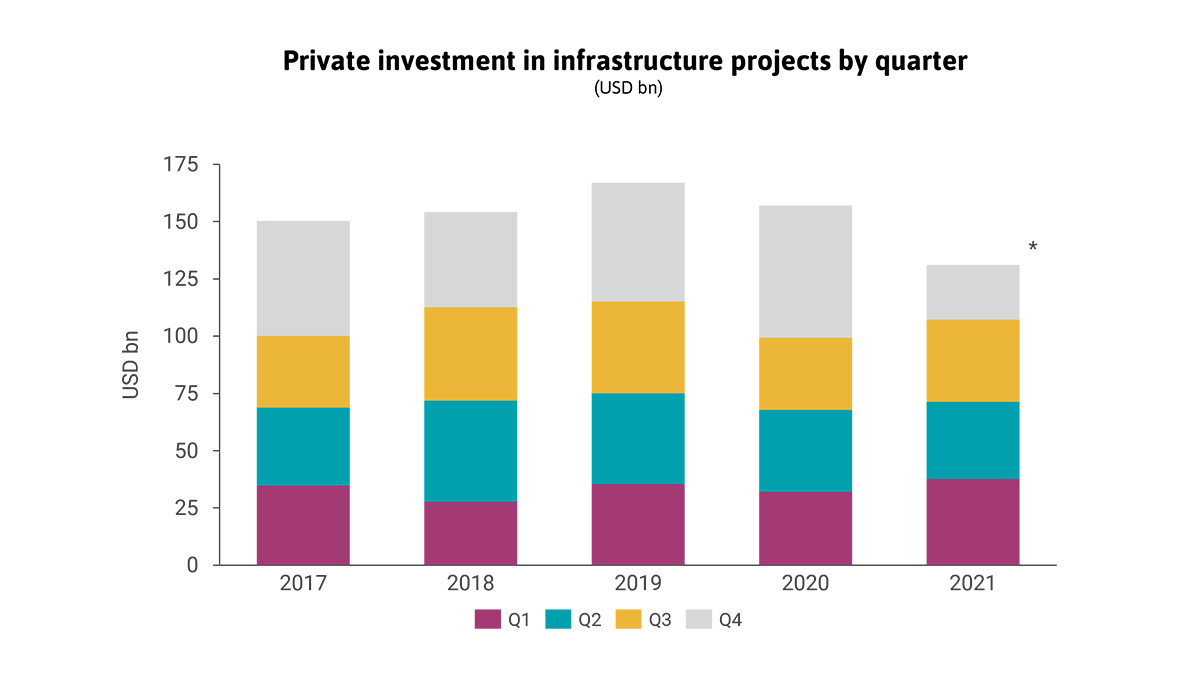

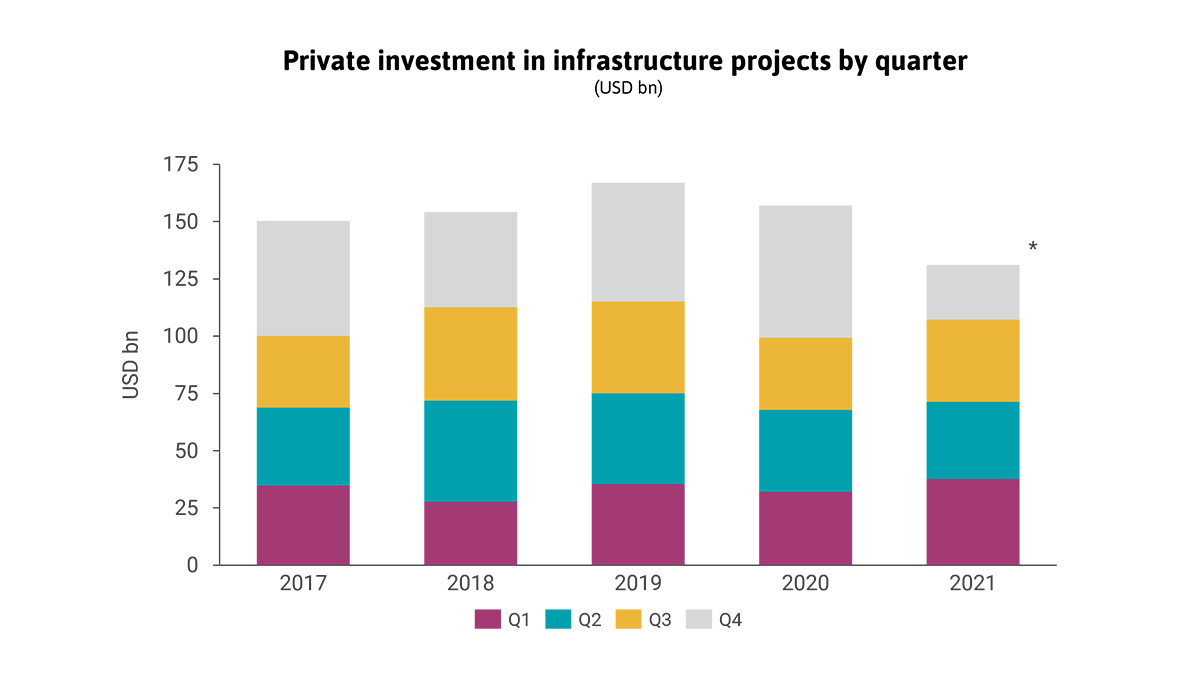

Private investment in infrastructure projects in primary markets has been stagnant for seven years running

In this session, the GI Hub provides an overview of our mission and mandate from the G20 and discusses two of the GI Hub’s key resources.

Low-income countries must maintain the necessary focus on basic goals such as improving energy access, providing safe and quality transport services, water, food security, and education - while forgoing opportunity, dealing with additional risks, and prioritising climate-smart investments.

The global pandemic and climate change concerns raised at COP26 have elevated awareness of the need to build sustainable and resilient infrastructure, in tandem with implementing adaptation strategies and governance through innovative and collaborative partnerships between the public and private sectors

Private investment in infrastructure projects in primary markets was resilient to COVID-19 pandemic shocks

This simple and free tool enables project proponents to easily conduct early-stage cost-benefit analyses of bus transport projects.

Alexandra Bolton, Executive Director of the Centre for Digital Built Britain shares why we need to invest in digital capabilities to improve infrastructure delivery.

Pension investment in infrastructure is moving mainstream, at a time when this move will have even greater potential to help drive positive impacts

Improving Delivery Models

Improving Delivery Models